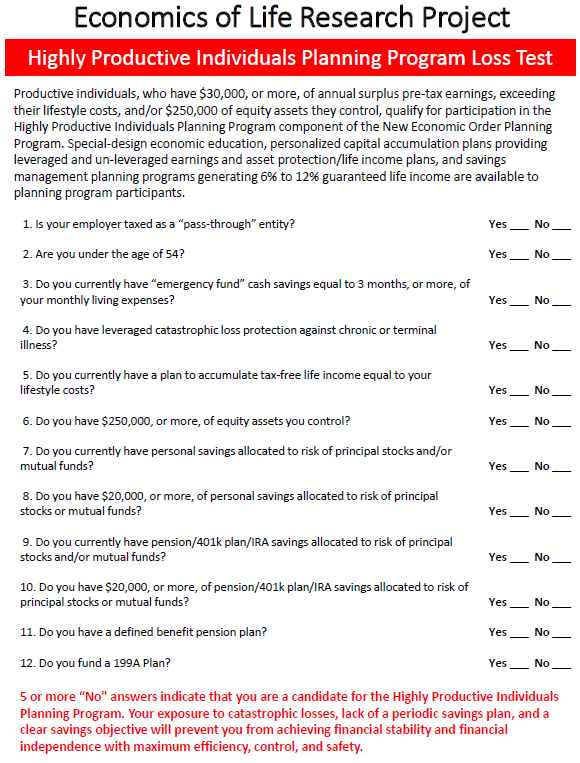

The Highly Productive Individuals’ Planning Program component of the New Economic Order Planning Program provides productive business owners and individuals access to special design economic education, earnings management, budget management, and savings management planning programs. Productive business owners and individuals who have more than $30,000 of annual earnings exceeding their lifestyle costs and/or $250,000 of assets they control qualify for participation in the Highly Productive Individuals Planning Program.

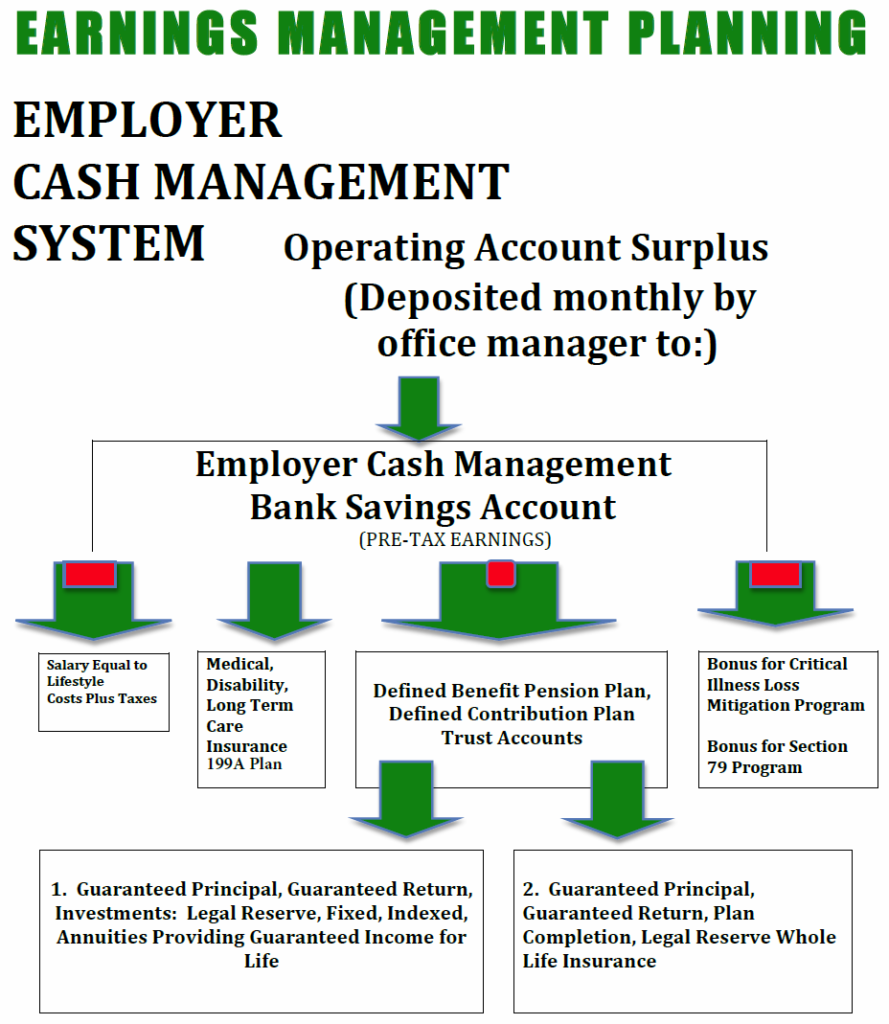

The Highly Productive Individuals Planning Program includes the establishment of an Employer Cash Management System that allocates accumulated surplus employer earnings to planning priorities: 1. Salary equal to lifestyle costs plus taxes, 2. Medical, disability, and long-term care insurance premiums, and 199A Plan 3. Qualified retirement plan trust accounts, and 4. Bonus for catastrophic loss and life income programs and for qualified retirement plan current economic benefit costs. Qualified retirement plan trust funds are then allocated to guaranteed outcome pension whole life insurance and pension annuities.

Special design 199A Plans and “Guaranteed Outcome” Defined Benefit Pension Plans prevent losses of surplus earnings to unnecessary income taxes.

The Guaranteed Outcome Defined Benefit Pension Plan is a major earnings and savings management component of the Highly Productive Individuals Planning Program. that generates guaranteed life income for participating small business owners, private practice doctors, and other productive individuals.

The 199A Plan is a major earnings and savings management component of the Highly Productive Individuals Planning Program that was created by provisions of the 2017 Tax Reform Act that generates 20 years of tax-free retirement distributions for participating small business owners, private practice doctors, and other productive individuals

The owners and key employees of the 2.8 million small businesses that comprise the most productive 10% of the 28 million small businesses in the country are prospects for Guaranteed Outcome Defined Benefit Pension Plans, the 199A Plan, and the Pension Accelerator Programs. Prospects for 199A Plans include owners of “S” tax status employers or other “pass-through” businesses that are age 54 and younger, who generate annual surplus earnings exceeding their lifestyle costs, of $20,000 to $100,000. The vast majority of these productive business owners, key employees, and other productive income-producing individuals currently do not have guaranteed life income that equals or exceeds their lifestyle costs.

There are two types of Pension Accelerator Loan Programs, one that generates taxable retirement distributions and one that generates tax-free retirement distributions. Prospects for the taxable-distribution Pension Accelerator Loan Program are productive, credit-worthy business owners and individuals age 65, and under, who earn annual compensation of $215,000, or more, have $50,000, or more, of surplus annual earnings available for 5 to 10 years, and are currently funding defined benefit pension plans at annual contribution levels that are below maximum annual funding levels.

Prospects for the tax-free distribution Pension Accelerator Loan Program are productive individuals and business owners age 54, and under, who are in good health, earn annual compensation of $100,000, or more, have $50,000, or more, of surplus annual earnings available for 5 years.

Another objective of the Highly Productive Individuals Planning Program is to prevent productive corporate executives’, small business owners’, and other productive individuals’ losses of their earnings, savings, and endowment assets to assisted living costs. The New Economic Order Planning Program provides access to a full return of premium, qualified long-term care insurance program for highly productive individuals. This asset protection and wealth transfer program prevents highly productive individuals’ losses of billions of dollars of personal and retirement plan savings to assisted living costs, while, at the same time, creating billions of dollars of family legacies and endowments for 501 (c) 3 non-profit organizations.

Productive corporate executives and directors, business owners and affluent individuals, age 40 and older, are prospects for the Full Return of Premium, Qualified Long-Term Care Insurance component of the New Economic Order Planning Program that utilizes up to $3 million of tax-free compensation or surplus savings to provide asset protection and wealth transfer benefits.

Click on the link below to download the PDF documents. Print them out and fill in the information.

Highly Productive Individuals Planning Program Loss Test