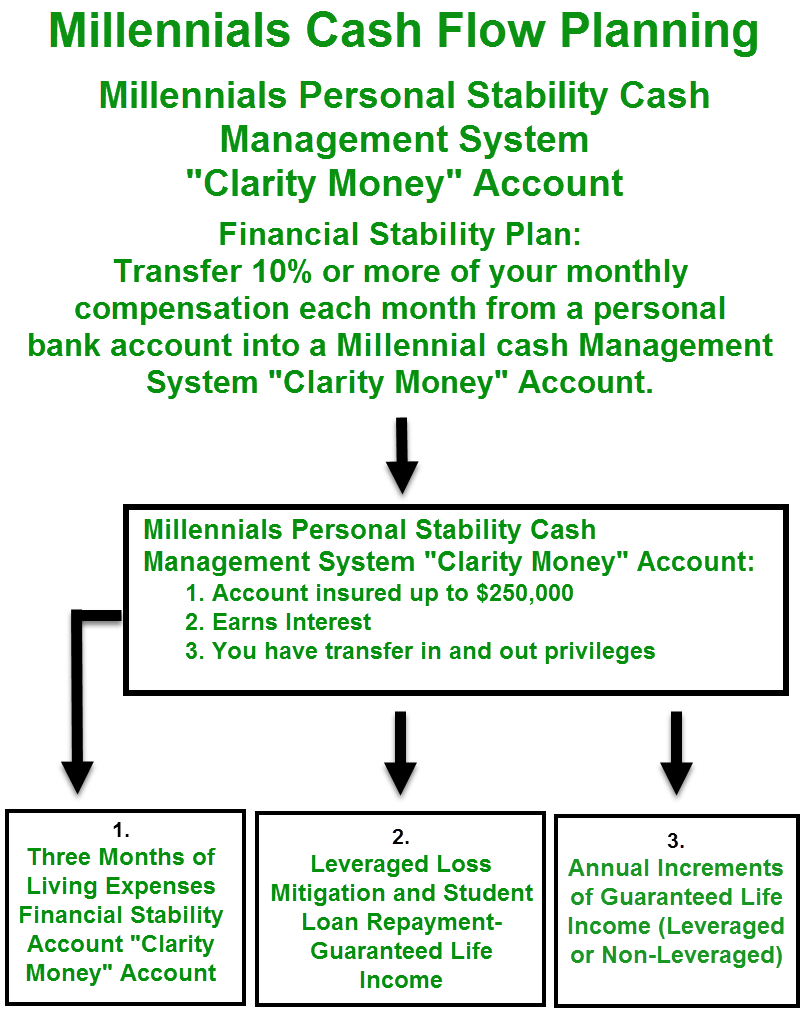

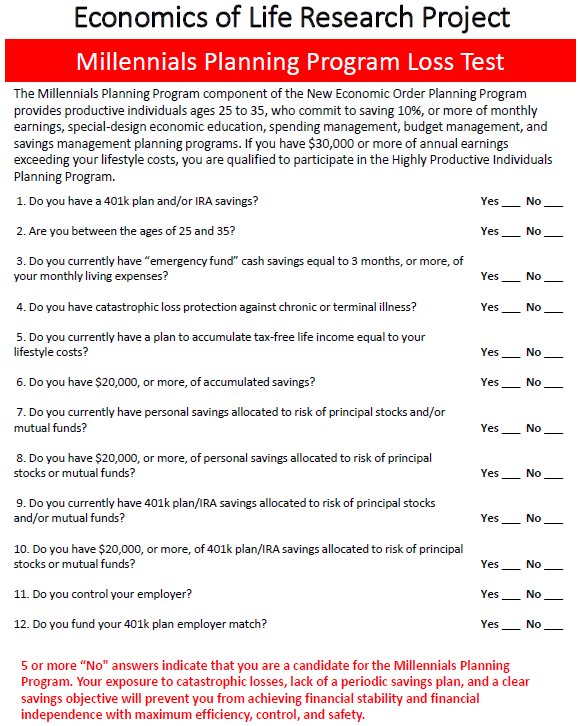

The Millennials Planning Program component of the New Economic Order Planning Program provides productive Individuals in the age 25 to 35 cohort of the population access to special design economic education, earnings management, budget management, and savings management planning programs. Millennials who have less than $30,000 of annual earnings exceeding their lifestyle costs qualify for participation in the Millennials Planning Program by making a commitment to save 10%, or more, of their monthly earnings. The Millennials Planning Program includes the establishment of a smart phone based personal cash management system that allocates accumulated savings to three planning priorities: 1. An emergency fund equal to 3 months living expenses, 2. A Catastrophic Loss Protection and Guaranteed Life Income accumulation planning program funded by special-design, equity indexed universal life insurance contracts, and 3. A life income accumulation plan funded with fixed, indexed, deferred annuities.

The New Economic Order Planning Program plans to provide these economic education and earnings and savings management planning programs to 200,000 productive Millennials during the next five years.

Productive Millennials, 25 to 35 years of age, are prospects for the Millennial Planning Program’s economic education component, for its Millennial Cash Management Account smart phone application, and for the Catastrophic Loss Mitigation Reserve and Life Income Program with its leveraged, accelerated, mortality gain financial instruments that are underwritten by legal reserve life insurance companies.

Click on the links below to download the PDF documents. Print them out and fill in the information.

9-23-19 Millennials Planning Program Loss Test

Millennials Membership Order Form