The Savers’ Planning Program component of the New Economic Order Planning Program helps individual savers ages 55 – 74, who have $20,000, or more, of personal and qualified retirement plan/IRA savings allocated to bank CD’s that are losing purchasing power, or allocated to stock market investments that experience periodic losses of principal that destroy the efficiency of compound interest. Savers’ personal and IRA savings are re-positioned into guaranteed principal, guaranteed growth, guaranteed life income financial instruments that are underwritten by legal reserve life insurance companies.

The Savers’ Planning Program component of the New Economic Order Planning Program helps individual savers ages 55 – 74, who have $20,000, or more, of personal and qualified retirement plan/IRA savings allocated to bank CD’s that are losing purchasing power, or allocated to stock market investments that experience periodic losses of principal that destroy the efficiency of compound interest. Savers’ personal and IRA savings are re-positioned into guaranteed principal, guaranteed growth, guaranteed life income financial instruments that are underwritten by legal reserve life insurance companies.

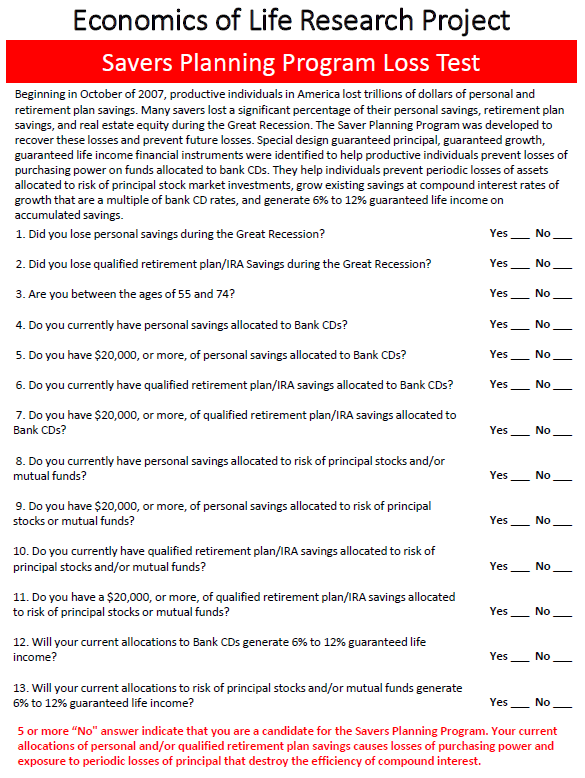

The financial instruments that fund this savings management planning program for individual savers are special design, guaranteed principal, guaranteed growth, guaranteed life income, fixed, indexed, deferred, annuities that are underwritten by legal reserve life insurance companies. Special design guaranteed life income withdrawal riders that are included in these contracts enable the saver and/or the savers’ heirs to retain control of their deposited funds during the life income period. The objective of the Savers’ Planning Program is, where possible, to prevent individual savers’ unnecessary losses of purchasing power on their savings that are allocated to bank CD’s, and to eliminate savers’ unnecessary periodic losses of principal on their savings that are allocated to risk of principal stock market investments. Periodic losses of principal destroy the efficiency of compound interest.

Click on the links below to download the PDF documents. Print them out and fill in the information.